Indians need to survive 2 types of Moratorium Fraud in COVID2019 Difficult Times

Table Of Content

In India, buying a home has become a Social Status for many. They don’t estimate their affordability in most of the cases which I had known. This makes them incompatible to pay their dues when a hardship situation arises. We would have funnily seen the memes which say “If you don’t love your job, take a Home Loan, you will love your job!”. Some people only for the reason of showing off, get the fancy loans and end up in crisis. And these types of people are highly found in India. After getting a Credit Card, followed by a Personal Loan, followed by a Car Loan, followed by a Marriage, followed by a Home Loan, followed by having 2 kids are considered as a Settled Person in India.

OK. Now coming to our topic of discussion. In this Coronovirus which is sweetly addressed as COVID2019 by scientists, the Reserve Bank of India has offered Moratorium for all the Loan Payers of India to help this situation. Very Good initiative initially alike other options provided by the Government of India in this series. It is worth mentioning the Rs. 20000000000000 towards the economic revamping of India where I saw the announcements for Sale of Airports and other Indian assets. Actually, this situation of COVID2019 is very well used by 2 peoples and will see the modus operandi of the schema.

Scammers

A variety of phishing campaigns are taking advantage of the heightened focus on COVID-19 to distribute malware, steal credentials, and scam users out of money. The attacks use common phishing tactics that are seen regularly, however, a growing number of campaigns are using the Coronavirus as a lure to try to trick distracted users capitalise on the fear and uncertainty of their intended victims.

Researchers have seen three main types of phishing attacks using Coronavirus COVID-19 themes — scamming, brand impersonation, and business email compromise. Of the Coronavirus-related attacks detected by Barracuda Sentinel through March 23, 54 per cent were scams, 34 per cent were brand impersonation attacks, 11 per cent were blackmail, and 1 per cent are business email compromise.

“People receive calls from call centres asking them to share their bank account details to avail moratorium on their home loan EMI. The point to remember here is that no bank will ever call you upfront asking for your bank details like OTP, CVV, password or PIN, for providing a moratorium on the EMI,” said Rajesh Kumar, Director Cybersecurity.

Stay Safe from Scammers!!!

Bankers

This discussion may be quite long. If you have a Bank Loan and planning to apply for Mortarium, please do proceed reading this long one. And than the Scammers, these Bankers are very dangerous. It reminds me the famous statement by the Frictional Character Tyrell Wellick saying “Give a man a gun and he can rob a Bank. Give a man a Bank and he can rob the world!”.

Yes, all Indian Banks are an Expert as per the above statement, of all my experience with dealing them without discriminating Government Bank or Private Bank or International Bank. My straight forward response or suggestion for anyone planning to opt for Moratorium would be “Shut Up, battle the COVID season and pay it without taking the Moratorium Advantage!”. Most of the Banks may or may not say the hidden truth just like the usual terms and conditions with hidden conditions.

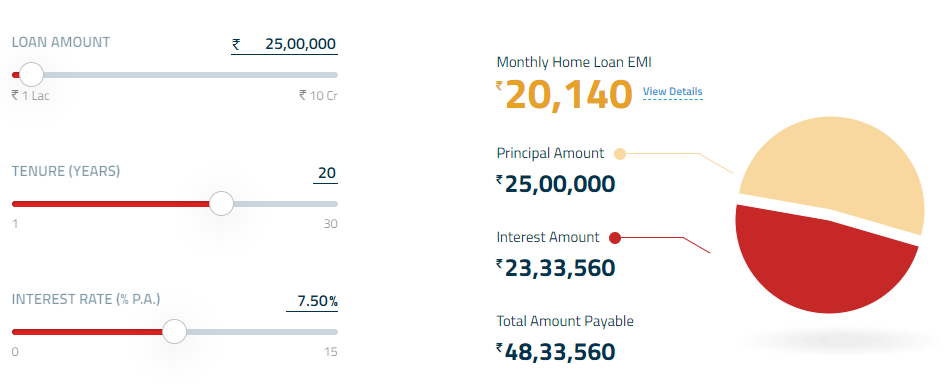

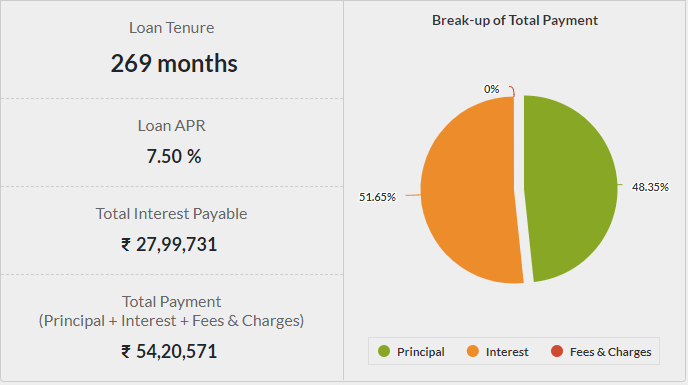

I will review here the Housing Loan, Rs. 25,00,000 for a tenure of 20 years at an Interest Rate of 7.50% per annum. On this case, I need to pay Rs. 20,140 as EMI per month. Don’t get shocked about the Total Amount payable, I have already written about the same in my previous blog here. See the loan options in the page.

Now, you are requesting a deferral for 6 months of EMI payment. The pending is increased by INR 1,20,840 (INR 20,140 * 6). So, according to the Bank, your loan liability has now increased by Rs. 1,20,840 totalling the value for INR 26,20,840.

In a nutshell, for deferring the 6 months of payment, you are extending the payment by 29 more months. Same Interest, Same EMI but increased Debt. Quoting that you aren’t able to pay INR 1,20,840 you have increased your debt by INR 5,84,060 which is 483% approximately of your actual payment. Ping me in my Social Media if you need more clarity.

![Documents Required for a UK [United Kingdom] ILR – Indefinite Leave to Remain Indefinite Leave to Remain (ILR) UK by Kokula Krishna Hari Kunasekaran Kae Kae](https://blog.kokulakrishnaharik.in/wp-content/uploads/2023/04/ilr-kae-kae-kokula-krishna-hari-k-4.jpg)