Moving Country is Challenging & Turns out to be the Best of Better Decisions – Moved to London, United Kingdom

If any amendments are required, please write to prm @ kokulakrishnaharik.in or DM at Facebook

Table Of Content

- Introduction

- Moving to another Country

- Art of Decision Making

- Increased Responsibility

- Missing Darlings

- Rental Property vs Own Home

- RENTING

- The benefits of renting

- The drawbacks of renting

- BUYING

- The benefits of buying

- The drawbacks of buying

- Choosing the Locality

- Getting New Home

- Property Hunting at the UK

- Financial Moves – India vs the UK

- null

- UK First Home Privilege

- Mortgage Options

- Conveyancing Solicitors

- Restarting Life

- Extended Freedom

- Loneliness

- Food Life

- Betterment

- First Things First – at London

- Conclusion

Introduction

Before furthering, this post may be interesting only for the people who love travelling or who moved across the borders. Potentially this could be a very long multipage post.

Since 2008, I have constantly been crossing borders of India vigorously for various purposes. In the year 2019, I have been locked down clearly at a fixed location and was forced to move out of the Republic of India [sarcastic]. The age of 29 is really bad to make this move and survive as a solo player. Moving abroad has allowed me to lead a life of adventure and a continuing expat life abroad. Every decision to move overseas is still one of my best, because of all the fantastic things that have happened because of them. Living abroad solo doesn’t seem like a big deal anymore, but it’s easy for me to say that after moving abroad alone, just like it is for all the people who travel alone.

When you move abroad solo, you can be a completely different person to who you were at home. No one knows who you are or what you were like before when you’re living alone in a foreign country. Whether you’re moving abroad apart at 30 or at 18, or even 50, it’s a chance to reinvent yourself or put into place new habits and stick to them. You can eat differently, exercise more, be a different kind of person socially, have different hobbies, wear different clothes, whatever you like. No one knows the old you and no one are there to question the changes or compare you to your old self. I think I’m very different from how I was through school and in some ways university too, and many people I knew then might be surprised if they met me again now!

Often I feel I go to some distant region of the world to be reminded of who I really am…Stripped of your ordinary surroundings, your friends, your daily routines…you are forced into direct experience [which] inevitably makes you aware of who it is that is having the experience. – Michael Crichton

Moving solo can be nerve-wracking at first, especially if you’re more of an introverted person like me, but once you realise you can do it your self-confidence will definitely grow. When you only have yourself to rely on, you’ll realise how strong you are.

The contents of the blog post may undergo a huge language issue not limited to Grammar issue, Active/Passive voice issue and much more. Neither you nor I am John Keats & Shakespeare! So avoid criticism on the Language usage, if you read my post and understood, awesome, else thanks and sorry that you had to spend time in reading this post. I spent more time in expressing the contents than doing language polishing.

Moving to another Country

I created loads of unexpected connections and friends. I’m not saying you shouldn’t move abroad with a friend, or move to where you know people, but there’s something to be said for being forced to go out and make connections of your own in a new place. When you travel or live abroad with someone else, it can be easier to stick together as a single unit, and you may find it takes longer to make connections of your own.

I love looking at gorgeous photos of dream destinations. It’s how most people–myself included–get ideas for future trips, or find the motivation to save for a big vacation. And it’s fun to scroll through Instagram and imagine what it would be like to live in a faraway place. There is always a difference between Moving to Another Country and Going for a Big Vacation. These two choices cannot be merged anyway. For me, after travelling bundle of countries Officially, Personally, and Diplomatically, I narrowed the choice as it should be one among the following USA, Canada, Australia or the United Kingdom. I know it is highly difficult to choose for a moron like me who perceive all countries equally. So, I decided that this choice should be offered to my better half (my future wife) and make the decision.

I was waiting for the better one to be my better half. Still, to my dismay, all the girls identified as most intelligent and brilliant by my parents weren’t highly compatible, and I feared to give such a responsible decision to be taken by them. So, I took the risk of identifying the right country for me without the aid of anyone else except Google. Had 3 complete sleepless nights while jotting down the country profiling. If it had been some official work, I would have escaped by saying “Sorry!”. But this decision was my life, and I don’t want to make any mistake. I was pretty confident and made my mind that if I commit any mistake, I should blame only ME, and it was ME.

Starting a new life abroad alone is a great way to meet people you might never have otherwise. An International Diplomat like me has read Diplomacy in textbooks and articles. The infield experience has brought insights about life, experiments and various others.

Art of Decision Making

The Art of Decision Making is a crucial vital game-changer, and as of now, I feel I pretty well utilized and made the right decision in choosing the country. As said by me, I wanted to move to a better Economy, better Healthcare, better Education and better Environment. The final result of the pre-analysis was Australia, Canada, the United Kingdom and the United States of America. I made all the considerations and worked out all the probabilities of finalising the situation.

I made my mind that I should never go through any consultancy strictly for this transition. This firm decision helped me a lot, and I will say you how. On an average, 81.77% of VISA applications be it immigrant or non-immigrant applications are being made by the so-called consultancies. They manipulate and tailor the information following the requirements of the VISA Officer to get the application granted. I felt that is highly injustice way back a decade ago.

The narrowed choices were finally processed based on various parameters like lifestyle, travel time to India, economy, politics, opportunities, threats, discrimination, ease of life, and various such fields. I had the UK as the top choice. All others were taken out on various constraints. In the meantime, I was offered a highly regarded Diplomatic Position in the London, United Kingdom by an International Organization. Thus my location has been finalized without other thoughts.

Increased Responsibility

Setting goals from being a kid was challenging for me. The problem is being realistic had been a question for me. I had to set a very high goal set and never compromise on the quantity as well as the quality. I don’t want this option as an attempt to run away from the poised environment. Deciding to move abroad was a no-brainer! I was ready to pack my bags, take a loss on our house, and put 6,800 miles between me and the bright golden looming spectre of disappointment. Humans are hard-wired to avoid stressful situations, and the “grass is always greener” mentality plays right into this. It would have been easy to let my desire to run away from responsibility influence my reasoning for moving abroad. Instead, we spent several weeks crunching numbers, doing research, and having deep conversations about whether or not this was the right decision.

The idea of getting out of your comfort zone is to put yourself into a state of more heightened mental awareness where you can be more productive, harness your creativity, learn to deal with unexpected changes and new things and then find it easier to do all of this in the future. It’s easy to stay in a rut when you stay at home, but moving to a foreign country alone is an opportunity to push yourself.

When life gives you lemons, it is always wise to make the best out of it. We expected depth to be more important than breadth because the longer people live abroad, the more opportunities they have to engage in self-discerning reflections; in contrast, whether these experiences occur in a single foreign country or in multiple foreign countries should be less important. In a nutshell, depth is more important than the breath.

Running away from home rarely ends well. We can just reinvent life. No one knows the old you and no one are there to question the changes or compare you to your old self. Just because of personal or professional reasons if you are moving out, don’t. You need to reconsider and replenish. Give yourself the time and space to process the real reasons to move to another country. This is not just visiting the country for a few days or taking a break.

Missing Darlings

While it can often feel like an adventure, moving abroad alone can sometimes bring inevitable feelings of homesickness. This is a significant loss for me. Decades ago, it would have been challenging to get in touch with family and friends when we are even 100 miles away. But these days, the system has been very comfortable with the advancement of technologies. Say Facebook, WhatsApp, Skype or others, we can connect with each other. The communication is a vital part of life, whenever there is an effort being rendered either by the local friend or family member or the expat who moved out, things would never be indifferent.

Please rid yourself of this idealism immediately. It’ll save you a lot of heartbreak and frustration. Keeping in touch takes a lot of effort, even without the added difficulty of translating through a new cultural lens. While you happily burble on about the fantastic roast duck at a hole-in-the-wall restaurant down the road, your friends and family back home will be nodding in polite interest. There will be an initial period of excitement over your new lifestyle, but it’ll fade. Your lives are on very different trajectories, and it can be hard for some people to understand what they have never experienced.

|

|

Recently, I brought my dad to my home in the United Kingdom for a fortnight. Next in the line, I have my mom to visit the United Kingdom. But my GSD is quite crazy, and he misses me badly. Not only my family and dog but my close associates in India also do miss me badly.

Rental Property vs Own Home

Rental Property is for INSECURE PEOPLE. I had fooled everyone into thinking I was good at my decisions, and there was no way I could let anyone think I was an incompetent buffoon. And a country like the United Kingdom has a very high rental price for the property when comparing to the mortgage options. Obviously, there is an obstacle for the IP (Initial Payment) or the rest of the LTV, but the option of owning home in the UK isn’t a bad deal when comparing to the option of renting home. When life in the UK isn’t guaranteed for the long term, people will go for the rental property.

My sorting analysis worked out again with my table occupied with data and information.

RENTING

The benefits of renting:

- It can be easier to move the house quickly when you need to

- Finding and renting a home is usually quicker than the process of buying

- No risk of losing money if the property’s price goes down

- Your landlord has to pay for repairs and renovations

- It is often cheaper and rental payments rarely change, making it easier to budget

- You may be able to rent a bigger home in a nicer area than you could afford to buy

The drawbacks of renting

- All of your rent payments go to your landlord, not towards owning a home

- If you never buy a house, you have to pay rent for your whole life, even after you retire

- If your landlord decides to sell or get new tenants, you have to move out

- Your landlord can set rules and restrict changes you can make to the property

- You have to pay a deposit, and the landlord may keep some or all of it

- Your landlord could decide to increase your rent

- Improving the property could increase its price, but this only benefits the landlord

BUYING

The benefits of buying

- Your monthly repayments go towards buying your home, not into a landlord’s pocket

- You fully own your home at the end of the mortgage’s term, and can then live rent-free

- You could make a profit if house prices rise

- You can live by your own rules without needing a landlord’s permission (e.g. having pets)

- You can make changes to the property such as redecorating or landscaping the garden

- Renovations and changes you make could increase your home’s value

- No landlord who could make you move house because they want to sell

- Buying can sometimes be cheaper than renting. The mortgage is cheaper than renting.

The drawbacks of buying

- Upfront costs like mortgage fees and stamp duty can make it pricier than renting

- If you get a joint mortgage and separate, it can be complicated to sell the property

- Interest rate rises can increase your monthly payments (unless you get a fixed rate)

- You have to pay for repairs, including if something urgent goes wrong like a leak

- Moving can take a long time because you have to sell your home first

- If your finances become tighter, moving to a cheaper property can take a long time

- There are financial consequences if you fall behind on repayments, like getting into debt

- If you fell too far behind, you could face bankruptcy or your home being repossessed.

I will tell you, after doing this deep analysis, I concluded that BUYING is better than RENTING in London, United Kingdom if you have the capacity. Paying rent all the life with nothing being left behind is considered as Dead Money and not a wise investment strategy.

Choosing the Locality

After being in Bristol, and visiting many of my friends within the UK, and especially the entire spaces of London, I finally select Harrow. In various terms, I felt Harrow a better place. History claimed the resilience values of Harrow to be at a higher rate. The multiculturalism, the access, availability and much more impressed me. Of many habitational names, I loved this place. Harrow is in the North-West part of London was typically positioned.

I roamed the entire London and most parts of the UK on various occasions. When checking out the place for dwelling, I had to consider various factors like Restaurants, Transport, Temples, Schools, Hospitals and many such facilities. I wanted to be very close with the Indian diaspora and Tamil Community, widely been to East Ham, Ilford, Croydon, Wembley, Ealing, Southall, Hounslow and other such. Moreover, the percentage of Indians in other areas were too much exploiting the existing British Whites of the areas.

Schools in this locality are more perfect and finely crafted. I happened to visit Harrow School with my friend, who was so much impressive. Harrow is often perceived as having a good educational record and features many state-funded primary and secondary schools as well as a handful of large tertiary colleges apart from the Harrow School where Indian and British Prime Minister had been to like Jawaharlal Nehru and Winston Churchill respectively.

In the near vicinity, we have Northwich Park Hospital, and in a few minutes of the drive, we have Central Middlesex Hospital for Medical Emergencies. Both these hospitals are very well equipped with Indian Language speaking assistants who would be highly helpful for the settlement of a family.

And without mentioning this, it wouldn’t be enough for choosing this location. Yes, you got it. It is about Restaurants. I have various cuisines of restaurants, takeaways and fine dining places. I am entitled to my own choice of choosing the food which I want. Until I am hooked up, I can try various food styles and bit healthy (when compared to India). Food points like Briyani Kitchen(Indian folks), Chicken Cottage(Sri Lankan), Sakonis(Indian Vegetarian) are my paradise.

After a series of considerations and sortings, I finalized Harrow is going to be my place.

Getting New Home

At the first instance, I made my mind just to rent a property for some time. When I started exploring the locality of Harrow & Brent, I learnt that the rent is higher than the mortgage, which I may be required to pay in the United Kingdom. After discussing with loads of people, I concluded my theory of owing a home than renting an apartment.

When all these things were finalised, I prepared myself with the Rest of LTV or the Initial Payment or Down Payment for my property after understanding the market situation in Harrow. But was confused about the eligibility and documents required. Since I was graduated in the United Kingdom and was holding a Bank Account and Credit Card technically since then, my credit score was pretty good. Also, during all my visits to the UK, I use to spend in GBP with my card and it, in turn, increased my score.

Initially, when I approached various Estate Agents, they were asking for AIP. I wasn’t aware of what it was and later came to know Application in Principle approval for the mortgage. I was asked for an appointment by the Financial Advisors of the Estate Agents for sorting this AIP. But I made all my way to HSBC with whom I was Banking since my Uni days. They were generous enough to give me an AIP for £780,000. On the other hand, I went to LLOYDS Bank too, and they also were in touch with me for offering the Mortgage. They ably provided an AIP for £975,000.

With these two AIPs, I moved for the Property Hunting on a High Priority. I decided out that I can stay in a Hotel Accommodation (Bed & Breakfast) until the Home/Flat/Maisonnette is sorted out because most of them demanded a term greater than 6 months. If it was just a room, it was available for 1 month or so which I was not comfortable on various terms like shared kitchen, shared bath and shared toilets.

Property Hunting at the UK

This Phase of the process was really tiring me physically. As I mentioned earlier, I wanted to go for Rental Property and visited numerous properties for Rent. Ended with a no show for all the properties because of the stringent conditions and/or minimum commitment period specified by the Landlord. Since day 1, I had been meticulous in entering into contracts or agreements with a specified tenure. But, still, my hunt was in progress, and it experienced a fathom shift from Rental Property to Sale Property.

The next decision I was forced to take was between Flat or Maisonette or Detached House or Semi-Detached House or Mansions or Terraced Houses or Bungalows. I am so poor that I cannot afford Mansions or Bungalows. Narrowed the options for Flats or Maisonettes. Even though the maisonettes were cheap, came with a garage, garden and no service fee, I preferred for the Flat as I am single and had a very less time to spend on the maintenance. Finally, I made my decision to go for an APARTMENT FLAT.

I visited a property which was available from November for rent in Harrow. All I did was with the Public Transport system (thanks for Transport for London – TfL and London Mayor), and I spent only £4.50 every day without the peak or off-peak fares. I felt the London was very well connected and it didn’t need private transport until it is a group or family members accompanying. There is also a reason why I choose public transport, it is just to measure the accessible distance. Basically and fundamentally, I am one of the laziest guys and don’t want to take a long way back home.

I did some research online too, pulled the legs of most of my folks in finalizing the property visits and many such. Distinctly, most of them ignored specific base points, assuming I would know that.

From an estate agent from Manchester, I happened to see a property listed in Harrow, London. I seemed bit weird and felt how they can co-ordinate, but still, with a blind trust, I gave a request to the Estate Agent. The agent, in communication with the property seller, confirmed the appointment and made the schedule to visit the property. I visited the property after a very long travel from my Hotel to my office in Central London and to my friends home in Enfield, and then to this property. Initially, I was shocked to see the property had a toddler.

In the course of my research, I heard that property having infants, toddlers, kids and pets are not recommended. Maybe, I will also have a kid in the future, and that shouldn’t be the option for the discrimination as per my choice. I had a pet, and obviously, that shouldn’t raise my eyebrows. To my shock, the home was very well maintained with usual wears and tears. The Indian Judgemental mind made me visit the washroom before finalizing the property. The property passed all the evaluation criteria now. I asked my folks to make the initial check of the property and property tenants(owners) which was all clear. I gave clearance and gave an offer to the estate agents, which was realistically impossible. After 3 rounds, we came for a final price.

Yes, I was glad to hear from the estate agent that “Congratulations Sir, your offer has been accepted by the buyer!”.

Financial Moves – India vs the UK

The insight I have gained after visiting various countries and analyzing their financial moves on Home Mortgage has widely helped in choosing the UK Mortgage. With most of my friends, back in India being a proud Home Owner, I have learnt loads of things from their damage. And, of course from my seer pleasurable pressure. I got a flat in Chennai, India, with around 40% as a Bank Loan. The loan was around INR 20,00,000 and at a point when I reviewed the accounts, I realized I would end up paying INR 56,43,676 if I paid promptly, which is 282% of the money I borrowed.

I have recently answered a question in Quora about the financial mistakes of Indian. Below is the link.

null

null

In India, if someone doesn’t own a Home or a Car is considered to be an unsettled man. This mirage is a perilous situation. Most of the Parents and Parent-in-Laws forced their kids for a lifelong commitment and destroy their happiness solely. A car is considered to be a risk for an average middle-class man. And still moving further the society forces them to go for a Home, say 1 Bed or 2 Bed in the city. Usually, I say when the Girls want NO DOWRY SYSTEM, the Boys also should be accepted in NO SETTLED STATE. Expecting 3 Bed House, posh car, International Vacations, Highly Qualified Education, Permanent Job, Hefty Bank Balance and others from boys with a condition of No Dowry is partiality. And these Girls do understand the same, whereas the Parents of the Girl fail to understand this and always wanted to give the best to their Little Princess. Anyway, that would deviate the topic.

Now, going for the mortgage in the United Kingdom is straight forward and quite cheaper when compared to India or other Asian countries. The UK starts the mortgage from 1.49% to 6.44% and even more, which I didn’t even consider for analysis. At the end of 35 years, I would end up paying 142% of the money which I borrowed. This figure is almost half the total of Indian figures.

UK First Home Privilege

There are numerous Government Help available if you are planning to buy a property or your first home in the UK. Though they vary from council to council, and city to city, most of them are beneficial. Unfortunately, I was not eligible for any of the Government Schemes as it had been only 1.5 months in the current VISA when I offered to buy the home.

There are loads of options for the people in the UK like Help to Buy, Shared Ownership, London Starter Home Option, Shared Equity Ownership, Right to Buy and Retired/Senior Residents home purchase schemes. I researched Help to Buy option, Shared Ownership option and London Starter Home options before moving forefront in this. I felt that those options had a catch or a trojan in the entire process.

The only privilege I was eligible was the SDLT. You didn’t get it right. Yes, the same way I was also rolling my eyes when I heard it for the first time. Later, I came to know that SDLT means Stamp Duty and Lant Tax to the HMRC. This is a tax amount paid to the UK Government for the property. When I purchased the property, I was exempted for the first £ 300,000 value of the property, and it was 5% for the rest of the amount until £ 500,000 as this would be the primary residence of me.

This had potentially saved around £ 11,400 when compared to the SDLT rates in 2012 or 2014. The ultimate condition for this scheme to be applicable was the intended property should be the Primary Property where you are going to live. There was a catch in the UK Government Policy which claimed that this must be the First Property in the UK. Apart from the declaration form, there were no checks performed (known to me) if I have any other properties. I utilised this privilege and saved around £ 11,400 of the total cost in my case. But there is a catch here too, the maximum savings can be only £ 5,000 in terms of stamp duty.

The UK’s First Home Privilege is available for both Freehold and Leasehold. It is applicable for all Properties without discrimination of type. The rules aren’t straight forward, but a deep analysis on case to case basis could save something. Also, one needs to note that apart from these there are other costs which may surge beyond like Survey Costs, Conveyancing Solicitors Fee, Mortgage Valuation Fee, Buildings Insurance (depends on the type and value), Initial Furnishing / Customizing (as per the Bank Balance weight and Spouse definitions) and other such things. Be prepared for them too.

Mortgage Options

The Mortgage Options in the United Kingdom has a broad spectrum. Types are not limited to Repayment Mortgages, Interest-only Mortgages, Fixed Rate Mortgages, Variable Rate Mortgages, Tracker Mortgages, Discounted Rate Mortgages, Capped Rate Mortgages, Offset Mortgages, and Buy to Let Mortgages.

Whichever mortgage you apply for, your lender will want to know you can continue to make your repayments. Even if interest rates rise, or as a result of any planned events affecting your financial circumstances.

You’ll need to provide evidence of your income and provide information about your outgoings, including Debts, Household bills, and Other costs, such as clothing, childcare and travel. To prove your income, you might have to produce payslips and bank statements. Lenders will work out your household income – including your basic salary and any additional income you receive from a second job, freelancing, benefits, commission or bonuses. Checking affordability is a much more detailed process. Lenders take all your regular household bills and outgoings into account, along with any debts such as loans and credit cards, to make sure you have enough left to cover the monthly mortgage repayments.

They also have to ‘stress test’ whether you could still afford the mortgage repayments if interest rates were to rise, or if you were to retire, go on maternity leave. Besides, they’ll make a Credit Check with a credit reference agency once you make a formal application to take a look at your financial history and assess how much of a risk lending to you might be.

If you’re struggling to get a mortgage to buy your first home, you might want to consider a guarantor mortgage. This means a parent, guardian or close relative agrees to be responsible for paying the mortgage if you cant. In the past, mortgage lenders based on the amount you could borrow mainly on a multiple of your income. This is known as the loan-to-income ratio. For example, if your annual income was £50,000, you might have been able to borrow three to five times this amount, giving you a mortgage of up to £250,000.

Now, when you apply for a mortgage, the lender will cap the loan-to-income ratio at four-and-a-half times your income.

Guarantor mortgages shouldn’t be entered into lightly. They’re legally binding arrangements. Your guarantor needs to be able to afford to pay your mortgage if you get into difficulty. You’ll need to talk to a mortgage broker to find out more about which lenders offer guarantor mortgages.

It’s never too early for you to start thinking about arranging a mortgage as this can be time-consuming. You can get a mortgage from an Independent Financial Adviser (IFA), mortgage broker or lender. Once you’ve found a mortgage product you like, agree with it as a mortgage ‘agreement in principle’.

This tells you how much money the lender is likely to offer and the interest rate you’ll pay. You might have to pay a booking fee to reserve the mortgage product you want. Typical cost: £99-£250, but in my case I didn’t pay anything.

Before you apply for a mortgage, check your credit report for any errors and to get an idea of your score. Lenders will look at it when considering your application. My score was pretty good. After you have received a binding mortgage offer, your mortgage lender must give you at least seven days to think about whether or not this is the right mortgage for you.

You can use this time to compare this offer with other mortgages. If you’re sure that this is the right mortgage for you, you can let the lender know in less than seven days that you want to go ahead. Mine was with the LLOYDS Bank. My Mortgage advisor was Adehi of LLOYDS Bank Wembley Branch. She understood all the requirements and suggested the right products. Since the first meeting with her, I gained the confidence that Lloyds can be me home loan lender. Throughout the process, I have contacted her in various instances, and she was patient enough to answer all my valid questions and stupid questions.

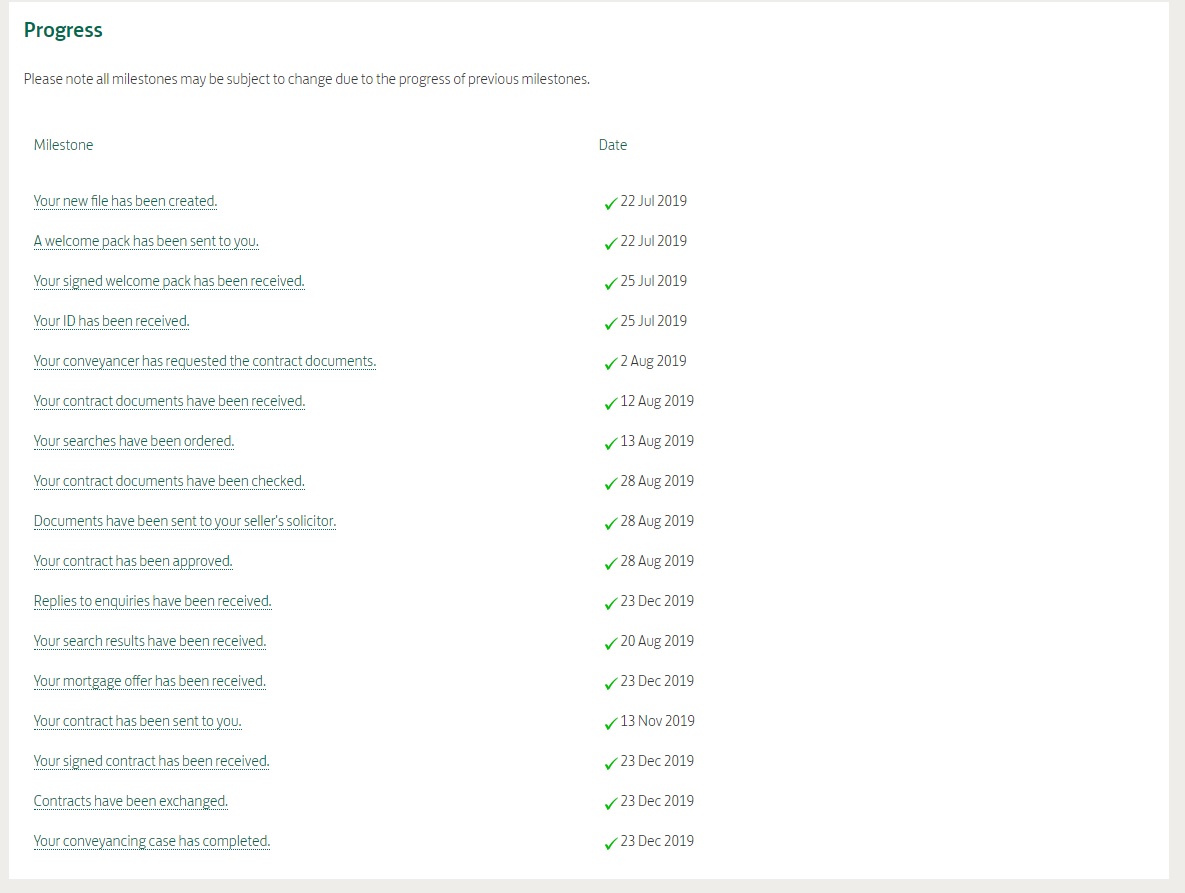

Conveyancing Solicitors

The primary key player in the process of buying a home in the UK is choosing the conveyancing solicitors. Ah, I was utterly exhausted in this segment. No one mentioned that it could be such tiring. My energy was drained like something of burning a jet fuel throttling 3000 gallons of fuel per hour.

In India, we have the so-called solicitors or the lawyers who do assist in the property registration. I have worked with many of them for my friends and colleagues who just do an overview, and nod their heads up for proceeding the document registration with the Registrar or the Sub-registrar. If we pay more to them, they will usually advise us to change the alignment of giving some 3 or 4 suggestions to be amended in the document.

On the other hand, in the United Kingdom, I experienced a very value for money process. My conveyancing solicitors were Gordons Property Lawyers, Maidenhead. These were suggested by LLOYDS Bank as their favourite and highly rated conveyancing solicitors of their pool. Since I didn’t have a big idea about this at the time, I went with the Bank’s choice. I instructed them to handle my case on July 22. During the telephonic calls and the LLOYDS Conveyancing portal mentioned that the conveyancing would be completed in 6 weeks. With a mirage, that the completion will be at the end of August 2019, I went to India after paying the necessary fees and send the KYC and AML documents to them. When I was in India, I was constantly tracking what was going on, but things didn’t move as expected.

Initial Days, there was really the highest level of sluggish move on my file. I felt they should have learnt the parallel processing. For example, for performing ID check, they were waiting for the contract documents where both are no way connected. After getting the contract documents, they took over 12 days for initiating the property search.

And similarly, it went until October, and I was promised many deadlines which were never achieved, and I wrote a strong email planning to discard the entire process by rolling back the decision. This process was having volatile dates in their dashboard and was kept changing every day, which was literally irritating me to the core. I was paying so much for B&B hotel, food, transport and others.

Based on those said deadlines, I ordered various stuff for my home, and most of them got delivered. I took storage and started dumping it. The landlord (previous owner) was really cool and helpful. They offered me the property for rent so that I can set up things and save the storage space. Things started working out, and I started doing some maintenance on the property by changing the window glass, fixing small holes and others.

At a point, my solicitors speeded up, and the seller’s solicitors started dodging things. I was constantly talking with the seller directly, they were kind enough to push their solicitors. God, it was much of fun loaded in the conversations, and I felt really childish at some point. It was like a seesaw game. The highlight is that when we both were pushing our solicitors, they went on vacation. That was another incident in this. I really chased them like a criminal under a serious charge which I never did earlier in my life.

Finally, all completed on 23rd December with enormous pressure from both me and seller in view of completing in 2019 and not dragging to 2020.

Restarting Life

This phase of life was more exciting for me, which cannot be compared with anything else. We need to cultivate the skill of filtering the information flung at you from every corner of our modern world and only allow yourself to be influenced by the voices that naturally resonate with you. Follow your own intuition and make your decisions with the self-assured confidence of someone who is committed to acting from a place of earnest truth. We need to acknowledge the dynamic nature of any relationship and to expand the boundaries.

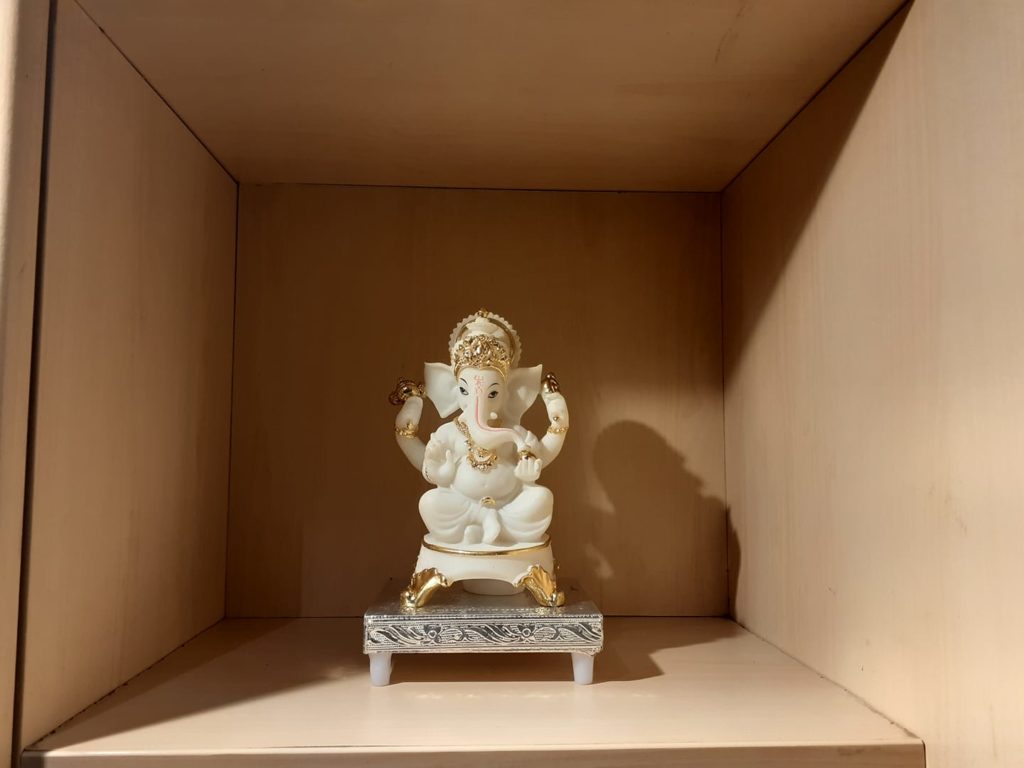

The above was the first image captured by me while visiting the Flat, which I offered to buy for the first time. From then, it had been a wonderful journey to the following below image. The journey had been so exciting and delivered a real rollercoaster effect.

|

|

Although somewhere I struck, difficulty being experienced and complex enough for me to understand, I learnt it Home Management. That was highly beneficial for being a quick learner. When someone can successfully complete a PhD in a Network Security and pursue a PhD in Public Policy, would it be difficult for learning Home Management? Never, it wasn’t such. I loved breaking plates, I burnt paper in Microwaves, overburnt the Pizza, wore the dress half washed, stored coconut oil in the refrigerator, spilt the milk over my hob, scattered the oil in the walls while preparing omelettes and what not in the list.

Setting up home Digital & automating was so fun and took my flat to the next level. Got 86 MBPS Internet Connectivity at my flat to catering all my needs. I did all sorts of creative works at the home. I came out of the comfort zone and created a comfort zone, to cradle me. I changed Bulbs to Smart Bulb, changed Wireless Thermostat to Wi-Fi Thermostat, changed Dimmer Switch to Wi-Fi-based switch, installed wireless cameras within the home and out of my flat for increased security.

Thus my life has completely changed and restarted a new phase.

Extended Freedom

I usually coin the term FREEDOM as a basic right of any citizen living in the world. Even the concept of VISA issuance isn’t acceptable as it limits the freedom of movement of an individual. Always Transport and Foreign Beauracracy is are red alerts. After sorting out the Home, Friends and Ties back in the home country now that you have the basics down, all you need to figure out is how to live in this new country. Keep in mind that there are many countries whose government offices move at a slower pace. This is when you learn patience, young grasshopper.

You’ll want to do a victory dance the first time you navigate public transit independently and successfully. It can be a daunting task, familiarizing yourself with all of those zillions of bus routes, carrying correct change in foreign currency, or buying a ticket from the automatic dispenser, with instructions written in what might as well be gibberish. Surprisingly, getting rid of most everything I owned was one of the hardest things I’ve ever done. A self-proclaimed shopaholic, I was inundated with tons and tons of “stuff!” Not only did getting rid of it all make me feel a million pounds lighter, but it broke me of an expensive and compulsive habit.

You’ll likely purchase plenty of random things living abroad: new clothes, coffee mugs, books and toiletries. But once you’ve gone through the process of “right-sizing,” you’ll realize that you can likely find anything you need in the next place you call home. In fact, you may just come to realize you don’t need it after all.

I also became comfortable being alone. It was so scary at first to think that my entire support system was thousands of miles away. But I learned to think on my feet and be resourceful when I had to make do with what little I had on hand. I also became adept at asking for help and met many wonderful neighbours as a result. Moving to an unfamiliar country will teach you patience. It might take a while to ease into the rhythm of your adopted home, but if you decide to stay for any length of time, you’ll need to learn to go with the flow. Your survival and happiness will depend on it!

Living in a foreign country will expose you to another culture and its customs. You might look at poverty and suppression and prejudice square in the eye. And when you do, you’ll realize how fortunate you are to have the freedom to live where you choose. Your friends and family will be fascinated by the fact you took such a huge leap. After all, you’ve just done something most people only dream about. Think of all the amazing stories you’ll have to share when you come back for a visit. Better yet, stay in touch virtually (or start a blog) so they can watch your adventures in real-time.

Speaking of adventures, you’ll likely become an adrenaline junkie. Your thirst for new and exciting experiences will increase. You’ll become braver. You’ll try things you might not have ever tried before. Moving abroad made me feel like I could tackle anything, including jumping out of a plane at 33,000 feet!

You’ll become a better communicator too. Even so, there are numerous dialects and communicating with the locals was challenging at times. However, I enjoyed the lively exchanges. When I took the time to really listen, I learned so much from local friends about their lives, their experiences and their dreams.

When you visit family and friends, you’ll feel like a tourist in your own hometown. Life will have carried on without you, and it may seem as if nothing has changed. But take the time to look at familiar places with fresh eyes and check out sights you’ve never bothered to visit before.

Living far from family and friends can be tough. You’ll learn to cherish every phone call from your kids and those surprise visits from your new neighbours. One day, a home might be a quaint cafe that has incredible coffee and a strong internet connection. Another day, it’ll be the peace you feel when you’re gazing out across the ocean or mountains or whatever view your new life affords.

Finally, pursuing your own happiness by living in another country entails something harsh but beneficial: Leaving a lot of familiar people behind. Unless you go with friends or have a partner, spouse and/or children, you will be on your own. Even as a team or family, expatriate life requires self-starting and perseverance because you no longer have the local community you always counted on at home.

If you go alone, you will be your own motivator, problem solver, and emotional stabilizer. You will have the chance to expand your people skills and build up your self-reliance. Perhaps the biggest potential benefit would be getting away from the influence of people who don’t value freedom the way you do. Sometimes your peers can hold you back. Taking off to a new country for a while can give you some breathing room without permanently severing ties.

Are you tired of the financial, political and social obstacles in your life? Living abroad may be the answer. It doesn’t have to be a “forever” commitment, it only takes months to prepare for, and the social and material benefits can serve you for the rest of your life.

More importantly, people in my hometown were fascinated about meeting me when I visited. Now, I am empanelled with numerous visitors, friends, colleagues, and others visiting me during a short visit.

Loneliness

When we say Extended Freedom, the concept of Loneliness also exists. Even though the population would be highly densely compounded, still we could be alone. Get ready to feel a bit lonely and even homesick from time to time. But don’t let these feelings get too deep. Falling into loneliness and depression is really dangerous.

Do you feel down? Try to remember why you are here. Maybe it was your dream to live abroad, it is easy to forget your inner why, but that is your engine, that is the fire that keeps you on track. Never forget your inner why.

My advice is simple: Don’t think about what is going on back in your home country. Don’t be melancholic and don’t daydream about good old times. It doesn’t help, it does the exact opposite. The biggest learning in this process is that “NOT ALL WHO START WITH YOU, FINISH WITH YOU!”. When I revealed the plan of moving abroad, over 100 wanted to join with me over the WhatsApp, 25% of the people dropped or changed their mind. At the same time, it progressed to the Phone Call, 50% of them dropped when it was for a meet out, most of them dropped out when it was to begin the journey with me, some dropped at the VISA Center, some at the Airport, some after making the first visit to the country and when I turned back, I was shocked that there was no one with me. The circumstances for everyone is highly dependent on their family situations, level of risk assessments and their capacity. I cannot blame any individual in that process, everyone wanted to be as a part, but not what we expect happens always.

The best way to fight loneliness is to go out and meet new people. Is there something you always wanted to try but never had “enough time” for it? This is the right time to try belly dance, take drawing lessons or start writing your own book. The choice is yours. Don’t let loneliness take over your days.

Moving to a new country allows you to think about your life, evaluate your interests, put yourself together and find out who you actually are as a human being. There are no old routines and no set rules. You have the opportunity to turn the page and start writing the story from the beginning. This is the time when you can find out how you are and what your goals are in life. Take your time and write everything down. Keeping a diary could be a good option to sort out your thoughts and feelings.

Moving to a new country is going to change you. Try to become a better version of yourself. This is your chance to make it right this time. Don’t be afraid and lose yourself to whatever feels right. Not everyone is given the second option in life. This is a Golden Ticket.

Food Life

It’s only natural to miss home, family dogs, colleagues and friends. I learnt not to be too harsh on myself and allow me some personal time to feel homesick and miss my guys. I have experienced numerous heartbreaks, betrayals, insults and much more. So losing them or missing them hasn’t been the worst moment for me. Try to embrace this feeling instead of fighting it. When you feel homesick, recognize that the feeling connects you to the place in which you were born or grew up and to the people you love still living there. You can always make a call home to talk to friends and family as much as you like.

While addressing these problems, food shouldn’t be a big problem. This would cause loads of physical health and mental health issues. In that way, being in London is blessed. Yes, you read it right. I never faced the shortage of Indian Food supply in London. And especially in Harrow with over 1/4th of the Indian & Indian origin population, I never felt that. Be it vegetarian or non-vegetation or Jain food or Hyderabadi Chicken Biryani, I got it in ample quantity. And moreover, the quality is exemplified without missing my way back Indian taste.

Food Life in London is highly impressive in my case, am not sure about the others. I usually don’t have Fish in India, but here the Cod and Salmon fish have started sailing in my stomach. Till this time, I have tried various cuisines, but I fear the possibility of listing all the cuisines. I have tried almost all Indian cuisines which include, Bengali cuisine, Andhra cuisine, Awadhi cuisine, Goan cuisine, Gujarathi cuisine, Hyderabadi cuisine, Karnataka cuisines(ones having sugar in Sambhar), Keralite cuisine, Mangalorean Cuisine, Maharashtrian cuisine, Mughlai cuisine, Odia cuisine, Parsi cuisine, Punjabi cuisine, Rajasthani cuisine, Sindhi cuisine, obviously South Indian cuisine, and Udupi cuisine. Even while I was in India, I haven’t tried so many varieties of food, but London treated me very well in the past few months with all of them.

| Glimpses of Food at Home | Glimpses of Restaurant Foods | ||

|

|

|

|

Not limiting only for the Indian Food, I have also tried International Cuisines like American, Arab cuisine, Bangladeshi cuisine, Caribbean cuisine, Chinese cuisine, Danish cuisine, of course, the basic authentic British English cuisine (bread breakfast & Fish’n’Chips), French cuisine without wine, Indonesian cuisine, Sri Lankan cuisine, Japanese cuisine, Korean cuisine, Malaysian/Malay cuisine, Mexican cuisine, Polish cuisine, Pakistani cuisine, Persian cuisine, Portuguese cuisine, Vietnamese cuisine and Thai cuisine in the city of London.

This short time has made me quite experienced with different food tastes as I can create a directory based on the taste! And I can also create a list of food taste prepared and served by all my friends, mates and their spouses, but considering the well-being of my friends and safeguarding them from being thrashed by their respective wives, I am refraining from that 😛

Betterment

Life changes when we move on. Let it be a deep relationship of love or friendship when things are not right moving on is the best option. In the same way, for the betterment of our lives when a country profile isn’t matching you, moving on is the best option. We should never regret the decision at any cost.

Even though hardly anyone is good at putting the good back into a goodbye, farewells do get a little easier over time. Maybe it’s because you know that you can go home and curl up on a couch that smells familiar – no matter where you travel to and from. Maybe you’ve also found a way to temporarily turn off all emotional organs, and you know that after a goodbye there’s always a hello.

Exciting things will happen without you – friends will get married, babies will be born, and legendary parties will be thrown. You’ll probably miss a whole lot of it and only catch selected moments on social media. It’s tough to accept, but – and it may or may not be a silver lining – it will be the same for your friends who miss out on all the amazingness in your life.

You might have moved abroad because of the weather or the crowded/boring streets. However, if you explain to people from another country where you live, your photos or descriptions are usually met with fascination and interest. Getting this outside perspective can give you a whole new appreciation for those streets back home and the nasty weather you normally complain about. Absence makes the heart grow fonder and possibly more patriotic – especially when you’re cheering on your country even though you don’t even like (insert sport of choice here).

Finally, my life is better now, interestingly.

First Things First – at London

We have tons and tons of things while moving to another country from a home country. This is highly challenging, and most of us don’t have a clear idea as what to do and what not to do. I was under significant pressure to have things right. You can read about my issue here. This is not an extensive full list, but as a solo migrant, this should be perfectly fine.

- Collecting your BRP (Biometric Residence Permit)

- Opening a Bank Account

- Registering with the GP (NHS)

- Get online access (Patient Access) with NHS

- Get your Oyster Card

- Seek appointment for National Insurance (NI) if it isn’t in your BRP

- Get Rain Coats & Umbrella for the entire family

- Setup Mobile & Internet services. It usually takes 15 days.

- Register for Voting with your local council.

- Apply for your Provisional Driving License (LLR). You can drive in the UK with Indian Driving License and no need for an International Driving Permit.

- Change Social Media location to #London, #UnitedKingdom and have a Display Picture next to the London Bridge or Tower Bridge. (Note Tower Bridge and London Bridge are different from each other – it took me 3 months to realize it)

- Register for Council Tax.

The above list is not full and not in order. But do let me know if I missed something by messaging me on my Facebook.

Conclusion

Not all the experiences are really remarkable. It was mixed. Experiencing skewed moments were uncomfortably exciting me in taking the next leap step ahead.

Proud Londoner! Proud Home Owner!! Proud of Myself!!!

![Documents Required for a UK [United Kingdom] ILR – Indefinite Leave to Remain Indefinite Leave to Remain (ILR) UK by Kokula Krishna Hari Kunasekaran Kae Kae](https://blog.kokulakrishnaharik.in/wp-content/uploads/2023/04/ilr-kae-kae-kokula-krishna-hari-k-4.jpg)